Willingness to join social health insurance and community-based health insurance among rural residents in Akwa Ibom state, Nigeria

Akwaowo CD1,2, Umoh I2,3, Udo AA3, Motilewa O1,2, Dan E2, Akpan N1, Ekpin V2, Umoh E2, Asanga N4

Abstract

Background: Universal Health Coverage seeks to ensure that all individuals have equitable access to quality health care with limited exposure to financial risk. Pooling of community members into health insurance schemes is necessary for the achievement of UHC. Most rural dwellers do not have health insurance and are susceptible to catastrophic health expenditure.

Objective: This study aims to determine the willingness of rural dwellers in Akwa Ibom state, Nigeria, to join health insurance schemes.

Methods: The study was conducted in three local government areas in Akwa Ibom State, Nigeria. It was a cross-sectional study with multi-stage data collection. Participants were 286 household heads. Data analysis was done using SPSS version 22 (New York), and statistical significance was set at 0.05.

Result: Majority of the household heads were 31-60years (71.0%), male (71.7%), had attained secondary education (43.0%), earned less than ₦20,000 (79.7%) and had spouses who earned less than ₦20,000 (72.0%). Only 30.1% had heard of health insurance, 2.5% belonged to a health insurance scheme. Majority of the respondents were willing to join a scheme, however, more participants were willing to join the proposed social insurance scheme (72.4%) than the community-based scheme (63.3%). Lack of funds and lack of trust were major barriers to joining a scheme. Frequency of illness was the only significant predictor of WTJ SHI (r= 0.141), while gender (r=0.186), educational level(r= -0.163), frequency of illness(r=0.142) and borrowing money for treatment(r=0.138) were significant predictors of WTJ CBHIS.

Conclusion: The study found low awareness of health insurance. There was high level of willingness to join the proposed health insurance schemes. Those not willing to join cited unaffordability as the major barrier to joining the schemes. We recommend increased awareness about health insurance schemes and policy makers should design schemes that will empower rural residents to uptake health insurance to achieve the goals of Universal Health coverage.

Keywords: Willingness to join, social health insurance, community-based health insurance, rural residents

Introduction

Health insurance is a very important tool in achieving Universal Health Coverage (UHC). This is especially true in low- and middle-income countries where out-of-pocket payment (OOP) for health service accounts for a large proportion of health expenditure.1 Consequently, coverage of the population with essential health services is low and is available only to a small proportion of the society.2 Universal Health Coverage (UHC) ensures that all individuals have equitable access to quality health care with limited exposure to financial risk.3 In 2019, at a UN High-Level Meeting on UHC, member countries including Nigeria affirmed their commitment to UHC.4 Currently, Nigeria's major strategy for achieving UHC is the National Health Insurance Scheme (NHIS), which is a contributory social health insurance scheme. Since its formal launch in 2005, not more than 5 percent of Nigeria's population has been covered by the scheme.5

Robust financing structures are essential in achieving UHC. Out-of-pocket (OOP) payment for health services is often catastrophic and perpetuates poverty and indebtedness.6 Furthermore, the poor often have difficulty affording many of the services they require, and even the rich may be at risk of financial hardship in the event of severe or chronic illness. Pooling of funds in form of health insurance can spread the financial risks of ill health across a population, thereby limiting catastrophic health expenditure.6 There are various mechanisms of funds pooling for health insurance and these include: Social Health Insurance (SHI), Community-based Health Insurance (CBHIS), Medical Savings Account,7 and Voluntary Health Insurance.

SHI is seen as a redistributive mechanism to ensure risk pooling and risk distribution among different segments of the society, particularly the employed and the unemployed. Although Social Health Insurance (SHI) holds a strong potential to improve financial protection and enhance utilisation among enrolled populations, it is often fragmented and inequitable, reaching mostly formal sector workers and exempting the poor who need it most.5 Even among the insured, SHI has a high proportion of ineffective insurance, where the insured still have to borrow or sell for health payment.8

Another model of risk and pre-pooling mechanism is the Community Based Health Insurance (CBHIS). It has been increasingly studied as an alternative means of health financing in rural areas (micro health insurance).9,10 In CBHIS, households in a community put together resources to finance a particular package of health services and are involved in the creation, planning and implementation of the scheme.11,12 CBHIS schemes are therefore, run mainly by the residents of the community and is focused on provision of access to basic health care to members of that community. Schemes are often voluntary in nature, created on the basis of mutual relationship and cover a variety of benefit packages, whereas, any other service not covered by the scheme is usually borne by the household.10 However, a health insurance scheme could be jointly run by the community and the public sector.13 Therefore, the key features of community participation, voluntariness, risk-pooling and pre-payment characterize CBHIS.

Despite the benefits of Health insurance,14,15 these schemes have been found to have low coverage where implemented, with the poorest people being excluded.5,13 It is against this background that this study aims to determine the willingness of rural residents in Akwa Ibom state, Nigeria, to join two different health insurance schemes: SHI and CBHIS schemes. This paper is one of the series of papers in a study to elicit the demand, interest in and willingness to pay for health insurance models and schemes in Akwa Ibom State Nigeria.

Method

Ethical Considerations

Ethical approval was given by the Institutional Health Research Ethics Board of the University of Uyo Teaching Hospital, Akwa Ibom State. The ethics approval number is UUTH/AD/5/96/VOLXXI/480. Written informed consent was obtained from all participants before data was collected. To protect confidentiality of participants, de-identified data collection was done, with participants names and other identifying information not obtained. To ensure further confidentiality, only those involved in data collection and the researchers had access to the data on the ODK app.

Study design:

A cross-sectional study design was used with multi-stage, non-probability sampling method.

Study Setting:

Akwa Ibom State is located in the South-South geopolitical zone of Nigeria between latitudes 40321'N and 50331 North, and longitudes 70251 and 80251 East. It is bounded by Cross River State to the East, Abia to the North, Abia and Rivers to the West, and the Atlantic Ocean to the South. This is an oil-rich state comprising 31 local government areas (LGAs), stratified into urban, semi-urban and rural. It has a population of about 5.48 million people, a land area of 7,081 km2 and has an urban-rural dweller ratio of 3:2.16 Majority of both urban and rural dwellers have no health insurance coverage. Currently, the State has not started the mandatory health insurance scheme.

The state is politically subdivided into three senatorial districts-Uyo, Eket and Ikot Ekpene. Each of the zones is made of 10–12 LGAs. The rural dwellers of the state practice mostly subsistence farming. However, those in the coastal areas are into fishing. The state is predominantly populated by the Ibibios, Annangs, and the Oron. The main populace are the Ibibios, other ethnic groups in the state are the Ibenos, and the Obolos, who are domiciled in the coastal parts of the state. However, a lot of foreign citizens from all over Nigeria reside in the state capital city, Uyo.

Study Sites, Sample Size and Sampling Method

The survey was conducted in three selected local government areas (Ibiono, Essien Udim and Esit Eket) of Akwa Ibom state. For the household survey, sample was determined using Raosoft Calculator for estimating single proportions in a population survey.17 Using a standard normal deviate at 95% confidence level, 5% margin of error, an estimate of possible true proportion of 20%, the sample size was 243 at 80% power. A 10% non-response rate was added to obtain 267 respondents, but the eventual sample size was 286.

In each of the three LGAs, enumeration areas were randomized to select communities. Selected communities were randomized for households. Heads of households were sampled by non-probability method.

The Instrument

The instrument used is titled the Demand Questionnaire. It comprised the following sections: Section A: Consent form, Identification sheet; Section B: Household Health Seeking Behaviour; Section C: Satisfaction with Existing Public Services; Section D: Income and Household Expenditure on Primary Care; Section E: Demand Assessment for Health Cooperatives and Section F: Interest in Prepaid Health Insurance and G: Contingent valuation to elicit WTP for health insurance. The instrument was developed specifically for the study.

Willingness to join health insurance (Section F of the instrument) was determined by creating hypothetical scenarios describing proposed service options for a publicly provided social health insurance scheme and a community-based health insurance scheme. The people's willingness to join the schemes was assessed:

Scenario 1:

Description of Proposed Service Option SOCIAL (HEALTH ONLY) INSURANCE

“Assuming you are invited to be a part of a health insurance scheme that you:

a. Can access health care for yourself and family at any time

b. Must make regular contributions to

b. Don’t have to pay full cost for service at point of use?

c. Can make regular contributions for ONLY health services

d. Can assist to pay for others who cannot afford to pay for health care in your community?

e. You can have some illnesses covered but not EVERYTHING IS GOVERNMENT RUN

Scenario 2:

Description of Proposed Service Option COMMUNITY-BASED (HEALTH ONLY) INSURANCE

“Assuming you are invited to be a part of a health insurance scheme that you:

a. Can access health care for yourself and family at any time

b. Must make regular contributions to

b. Don’t have to pay full cost for service at point of use?

c. Can make regular contributions for BOTH HEALTH AND OTHER services

d. Can assist to pay for others who cannot afford to pay for health care in your community?

e. You can have some illnesses covered but not EVERYTHING IS COMMUNITY CONTROLLED

Data Collection

Data collectors gathered data using the ODK Collect app on their phones. The ODK is an open-source Android app that replaces paper forms used in survey-based data gathering. It supports a wide range of question-and-answer types and is designed to work well without network connectivity.18

Data Analysis

All analyses were performed using IBM SPSS version 22 (New York). Descriptive statistics was used to summarize demographics. We performed chi square/Fisher’s exact analysis to determine the relationship between willingness to join the different HI models and the health seeking behaviour and health expenditure of the respondents. Pearson correlation was also used to determine the association between willingness to join the different HI models and selected characteristics of the respondents. Significance level was set at 5%.

Results

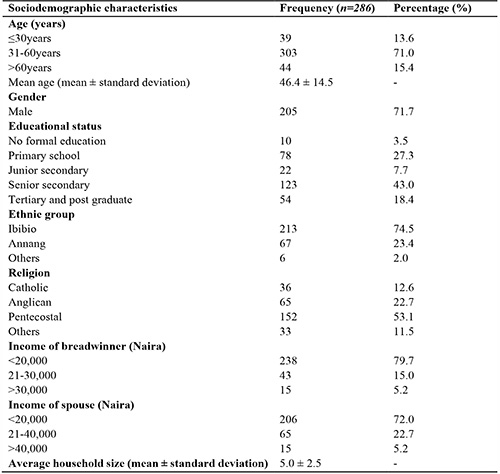

Two hundred and eighty-six household heads participated in this study. The mean age (SD) of respondents was 46.4 (14.5) years. Majority were male (71.7%), had attained senior secondary education (43.0%), were Ibibio by tribe (73.0%) and were of Pentecostal faith (53.1%). Most household heads earned between <20,000 naira (41.6%), and similarly most of their spouses earned <20,000 naira (72.0%). The average household size of respondents was 5.0 ± 2.5 (table 1).

Table 1: Sociodemographic characteristics of respondents

Demand for health insurance

Of 286 respondents, 86 (30.1%) had heard of health insurance and Only 7(2.5%) belonged to a health insurance scheme.

A total of 207 (72.4%) respondents were willing to join SHI scheme, while 181 (63.3%) were willing to join a CBHIS scheme. Seven (2.4%) were not sure of their willingness to join the SHI while 8(2.8%) were not sure of their willingness to join the CBHIS. Only 85(29.7%) of the respondents thought their neighbours were willing to join public HI schemes, while only 90(31.5%) thought their neighbours were willing to join HI schemes run by the community. Majority were not sure if their neighbours would join either of the schemes (SHI: 130(45.5%); CBHIS: 128(44.8%))

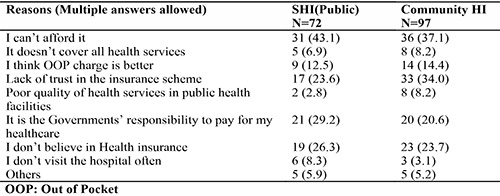

Table 2: Reasons for unwillingness to join different health insurance schemes

As seen in table 2, the commonest reason given for not joining both health insurance schemes was that they could not afford it (SHI: 43.1%, CHI: 37.1%). Over a third of those who were not willing to join the CBHIS (34%) stated lack of trust in the scheme, while less than a quarter of those unwilling to join the SHI (23.6%) stated lack of trust as the reason.

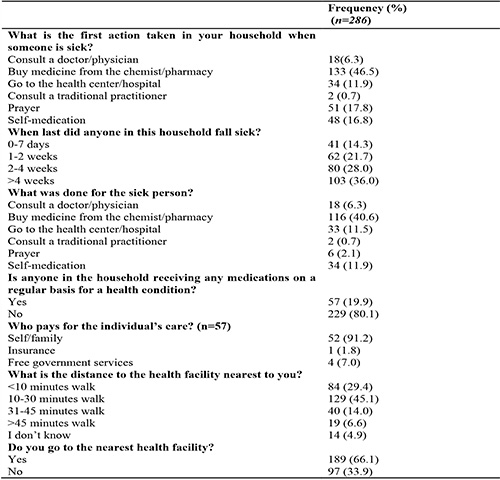

Table 3: Household health seeking behaviour

Table 3 shows the household health seeking behaviour of the participants. Most participants (46.5%) bought medication from a chemist or pharmacy when someone was sick and only 11.9% went to the health center/hospital. For most households (36.0%), the last episode of illness occurred over 4 weeks prior to this study, where treatment was mainly by over-the-counter medicine from a chemist or pharmacy (40.6%). Less than one fifth (19.9%) of households had someone receiving any medications for health conditions on a regular basis and most of these were self-funded (91.2%).

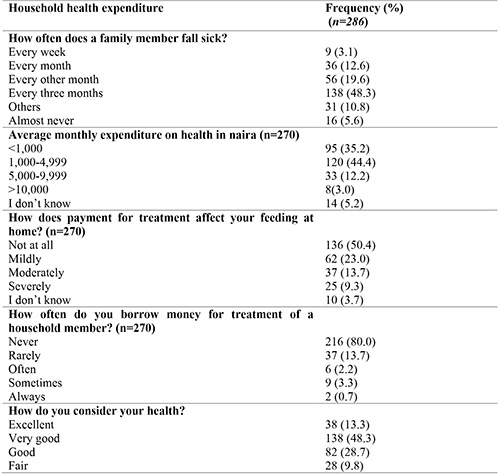

Table 4: Household expenditure on health

Most households had members who were sick every three months (44.4%), and spent 1,000-4,999 naira on health monthly. Health expenditure did not affect the feeding of most households (50.4%), and majority (80.0%) never borrowed money to pay for medical treatment of a household member. Most participants (48.3%) considered their health to be good (table 4).

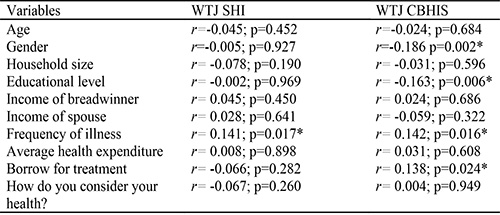

In table 5 frequency of illness was seen to have a statistically significant, but weak association with WTJ social health insurance scheme. Similarly, gender, educational level, frequency of illness and borrowing money for medical treatment all had significant but weak relationships with WTJ community health insurance.

Table 5: Correlation between willingness to join the different health insurance schemes and selected characteristics of respondents

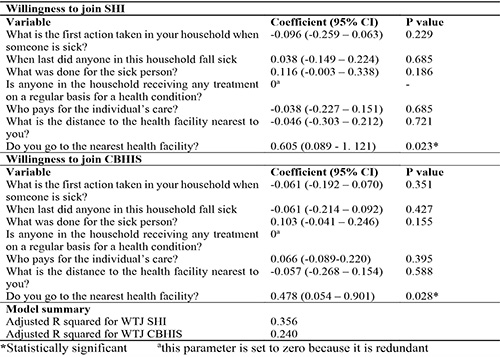

Controlling for other variables, visiting the nearest health facility was significantly associated with willingness to join the SHI scheme with an odds ratio (95% CI) of 0.605 (0.089 - 1.121). Visiting the nearest health facility was also significantly associated with willingness to join the SHI scheme with an odds ratio (95% CI) of 0.478 (0.054 – 0.901). This is further illustrated in Table 6.

Table 6: Association between respondents’ household health seeking behaviour and their willingness to join the SHI and CBHIS schemes

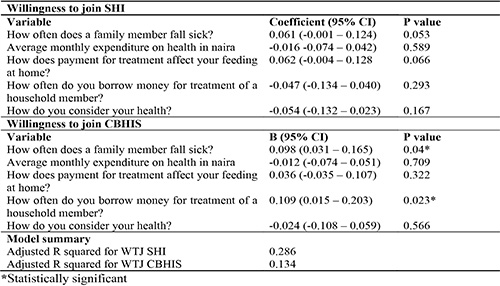

Table 7 showed no significant association between WTJ SHI and household health expenditure of participants. However, frequency of illness of house hold members [Odds ratio (95% CI): 0.098 (0.031 – 0.165)], and how often they borrow money for treatment of a household member [Odds ratio (95% CI): 0.109 (0.015 – 0.203)] were significantly associated with WTJ the proposed CBHIS scheme.

Table 7: Association between respondents’ household health expenditure and their willingness to join the SHI and CBHIS schemes

Discussion

This paper aimed to determine the willingness to join health insurance schemes among rural dwellers in Akwa Ibom state Nigeria. We found that less than a third of the participants (30.1%) had heard of health insurance, and only 2.5% belonged to a health insurance scheme as at the time of the survey. Majority of the respondents were willing to join a health insurance scheme, however, more participants were willing to join the proposed SHI scheme (72.4%) than the CBHIS scheme (63.3%). On correlation analysis, frequency of illness was the only significant predictor of WTJ SHI, while gender, educational level, frequency of illness and borrowing money for treatment were significant predictors of WTJ CBHIS.

The sociodemographic profile of the participants revealed that most participants were 31-60years old and were male. These are in their prime and are therefore actively involved in programs to develop the community. In Nigeria, male-led household heads are the norm with only 18% of households being led by female,19 which explains the male predominance in the study. Male respondents were more willing to join the CBHIS scheme when compared to their female counterparts. This agrees with findings in other studies.20,21

Majority of the study respondents had secondary level of education with only 18.4% attaining tertiary level of education. This is consistent with findings in other rural areas.10,22 Education plays an important role in economic growth of a community; hence, the low educational status explained the low income reported by participants and their spouses. Studies have demonstrated low levels of income and lack of financial resources as major factors leading to low enrolment in health insurance schemes.23,24 In contrast, although there was a high willingness to enrol, income did not predict the willingness to join the schemes.

The level of awareness of health insurance among the participants was very low (30.8%), despite the existence of a pilot CBHIS scheme in one of the study LGAs.12 This shows that information about health insurance has not been adequately disseminated in rural areas. A study among artisans in Abakaliki, South-east Nigeria reported similar low levels of awareness of CBHIS (28.7%).25 However, a study in Northern Nigeria found high level of awareness of CBHIS among rural participants (84.5%).26 This was attributed to ongoing sensitization programs in these communities. Another study among market women in the rural areas in the South-west found low levels of awareness of social health insurance and only 41.3% had heard of the NHIS.24

With the low level of awareness of HI seen in our study, it was no surprise that only 2.5% were enrolled in a health insurance scheme, in contrast to the findings by Ogben and Ilesanmi (2018) of greater than 50% enrolment in the scheme.26 The uptake of health insurance reported in rural Ghana was much higher (34%) than was observed in this study.22 The observed difference may be due to the fact that the participants in the Ghanaian study were selected from microfinance groups which may make them more financially literate and therefore, more likely to have health insurance.

Although very few participants were on a health insurance scheme, majority showed interest in joining a health insurance scheme. Reasons for unwillingness to join include inability to afford the scheme, lack of trust in the set up and management of the schemes, non-belief in health insurance and the perception that it is the government’s responsibility to pay for their health care. Significantly, the perception of poor service availability in primary health centers was very low. A similar study reported that lack of knowledge and lack of general interest in health insurance were the main reasons for unwillingness to join health insurance.21

More participants were willing to join a social health insurance (SHI) compared to a CBHIS. This could be attributed to a lower level of trust in the community leadership, compared to trust in the central government. This is evident as over a third of those who were unwilling to join the CBHIS stated lack of trust as the reason. One of the key principles of a good functioning CBHIS is the solidarity and trust between members. These stir up members who are susceptible to risk to put together their resources for common use.27 However, where there is lack of trust between members of a community, this would limit the useability of the CBHIS. Dror et al (2016) opined that clarity about the legal or policy framework of the scheme would facilitate its uptake in a community.28 On the other hand, the SHI is government-run, and does not depend on social capital. Trust in the government may be responsible for more people indicating willingness to join the proposed SHI. A similar study in a rural area in Nigeria reported that 83.9% of their respondents were willing to participate in the existing SHI.29

The enthusiasm to participate in both of the proposed schemes was threatened by lack of funds. A high proportion of the individuals who were not willing to participate in SHI and CBHIS schemes stated an inability to afford them as the reason. However, these are the people that even require health insurance the more, as pooling of funds will help prevent catastrophic health expenditure which could push them further into poverty and debt. A systematic review reported that lack of funds was a major reason for low CBHIS coverage in low- and middle-income countries.23

This study revealed that frequency of illness of household members was positively correlated to willingness to join both insurance schemes. Similarly, borrowing for treatment of family members was weakly correlated with WTJ CBHIS. This agrees with a previous study that found that medical bills predicted the willingness to pay for SHI scheme.30 Our study therefore, shows that frequency of illness episodes and having to borrow money for treatment predicts willingness to join health insurance schemes.

The limitation of this study is that it was carried out only on rural residents and did not study urban residents whose socio-demographics and income level may differ markedly. Therefore, the findings cannot be generalized to the entire population. However, considering the fact that over 60% of Nigerians live in the rural areas, the findings of this study is significant for designing inclusive health insurance schemes.

Conclusion

This study found a low level of awareness and a very low level of uptake of health insurance among rural dwellers in Akwa Ibom state, Nigeria. There was high level of willingness to join the proposed health insurance schemes, with more participants being willing to join the SHI compared to the CBHIS. Inability to afford, lack of trust and a lack of belief in health insurance were mostly responsible for unwillingness to participate in both health insurance schemes. Increased frequency of illness was the only significant predictor of WTJ SHI, while male gender, higher educational level, increased frequency of illness and borrowing money for treatment were significant predictors of WTJ CBHIS.

The authors recommend that awareness be increased in rural areas about health insurance schemes. We recommend that stakeholders designing health insurance schemes should prioritize trust and solidarity among community members in health insurance scheme. The government should take advantage of the trust reposed upon them by the people to implement schemes targeting the rural areas as government involvement will gain wide acceptance by the rural dwellers. The government should also set up safety nets and design policies that empower rural dwellers socioeconomically. This will make contribution and participation in the schemes more accessible and affordable to the rural dwellers, improving their health seeking behavior and the achievement of Universal Health Coverage.

References

- Nemati E, Nosratnejad S, Doshmangir L, Gavgani V. The out of pocket payments in low and middle-income countries and the affecting factors: a systematic review and meta-analysis. Bali Medical Journal. 2019 Dec 1;8:733.

- Peters D, Garg A, Bloom G, Walker D, Brieger W, Rahman M. Poverty and Access to Health Care in Developing Countries. Annals of the New York Academy of Sciences. 2008 Jul 25;1136:161–71.

- Aregbeshola B. Enhancing Political Will for Universal Health Coverage in Nigeria. MEDICC Rev. 2017 Jan 1;19(1):42–6.

- World Bank. Universal Health Coverage [Internet]. World Bank. 2021 [cited 2021 Jun 15]. Available from: https://www.worldbank.org/en/topic/universalhealthcoverage

- Alawode GO, Adewole DA. Assessment of the design and implementation challenges of the National Health Insurance Scheme in Nigeria: a qualitative study among sub-national level actors, healthcare and insurance providers. BMC Public Health. 2021 Jan 11;21(1):124.

- Flannery D, Garvey J, Inyang U. The Financial Protection of National Health Insurance: Evidence From a Cross Section of State and Federal Workers in Akwa Ibom, Nigeria [Internet]. In Review; 2021 Apr [cited 2021 Jun 15]. Available from: https://www.researchsquare.com/article/rs-366984/v1

- Piya H. Medical Savings Accounts: Lessons Learned from Limited International Experience. In: Department “Health System Financing, Expenditure and Resource Allocation” (FER) Cluster “Evidence and Information for Policy” (EIP). Geneva: World Health Organization; 2002. p. 57.

- El-Sayed AM, Vail D, Kruk ME. Ineffective insurance in lower and middle income countries is an obstacle to universal health coverage. J Glob Health. 2018 Dec;8(2):020402.

- Collins D. Assessment of Akwa Ibom Community-Based Health Insurance (CBHIS) Pilot Scheme. 2015.

- Oriakhi HO, Onemolease EA. Determinants of Rural Household’s Willingness to Participate in Community Based Health Insurance Scheme in Edo State, Nigeria. Studies on Ethno-Medicine. 2012 Aug 1;6(2):95–102.

- Onwujekwe OE, Uzochukwu BS, Ezeoke OP, Uguru NP. Health Insurance: principles, models and the Nigerian National Health Insurance Scheme. International Journal of Medicine and Health Development. 2011;16(1):45–56.

- Collins D. Assessment of Akwa Ibom Community-Based Health Insurance (CBHIS) Pilot Scheme. PLAN-Health Project. Management Sciences for Health; 2015 Feb.

- WHO. Community based health insurance [Internet]. 2020 [cited 2021 Aug 4]. Available from: https://www.who.int/news-room/fact-sheets/detail/community-based-health-insurance-2020

- Freeman JD, Kadiyala S, Bell JF, Martin DP. The Causal Effect of Health Insurance on Utilization and Outcomes in Adults: A Systematic Review of US Studies. Medical Care. 2008 Oct;46(10):1023–32.

- Pan J, Lei X, Liu GG. Health Insurance and Health Status: Exploring the Causal Effect from a Policy Intervention. Health Economics. 2016;25(11):1389–402.

- Akwa Ibom (State, Nigeria) - Population Statistics, Charts, Map and Location [Internet]. 2017 [cited 2021 Aug 4]. Available from: https://citypopulation.de/php/nigeria-admin.php?adm1id=NGA003

- Raosoft. Sample Size Calculator by Raosoft, Inc. [Internet]. [cited 2021 Aug 8]. Available from: http://www.raosoft.com/samplesize.html

- ODK Collect — Open Data Kit Docs [Internet]. [cited 2020 Mar 12]. Available from: https://docs.opendatakit.org/collect-intro/

- World bank. Female headed households (% of households with a female head) | Data [Internet]. 2018 [cited 2021 Aug 15]. Available from: https://data.worldbank.org/indicator/SP.HOU.FEMA.ZS

- Dong H, Kouyate B, Cairns J, Mugisha F, Sauerborn R. Willingness-to-pay for community-based insurance in Burkina Faso. Health Econ. 2003 Oct;12(10):849–62.

- Adedeji AS, Doyin A, Kayode OG, Ayodele AA. Knowledge, Practice and Willingness to Participate in Community Health Insurance Scheme among Households in Nigerian Capital City. Sudan Journal of Medical Sciences (SJMS). 2017 May 28;9–18.

- Alesane A, Anang BT. Uptake of health insurance by the rural poor in Ghana: determinants and implications for policy. Pan Afr Med J. 2018 Oct 19;31:124.

- Adebayo EF, Uthman OA, Wiysonge CS, Stern EA, Lamont KT, Ataguba JE. A systematic review of factors that affect uptake of community-based health insurance in low-income and middle-income countries. BMC Health Services Research. 2015 Dec 8;15(1):543.

- Adewole DA, Akanbi SA, Osungbade KO, Bello S. Expanding health insurance scheme in the informal sector in Nigeria: awareness as a potential demand-side tool. The Pan African Medical Journal [Internet]. 2017 May 19 [cited 2021 Aug 15];27(52). Available from: https://www.panafrican-med-journal.com/content/article/27/52/full

- Azuogu BN, Eze NC. Awareness and Willingness to Participate in Community Based Health Insurance among Artisans in Abakaliki, Southeast Nigeria. Asian Journal of Research in Medical and Pharmaceutical Sciences. 2018 Aug 10;1–8.

- Ogben C, Ilesanmi O. Community based health insurance scheme: Preferences of rural dwellers of the federal capital territory Abuja, Nigeria. J Public Health Afr [Internet]. 2018 Jul 11 [cited 2020 Feb 9]; Available from: https://publichealthinafrica.org/index.php/jphia/article/view/540

- Donfouet HPP, Mahieu P-A. Community-based health insurance and social capital: a review. Health Econ Rev. 2012 Apr 4;2:5.

- Dror DM, Hossain SAS, Majumdar A, Pérez Koehlmoos TL, John D, Panda PK. What Factors Affect Voluntary Uptake of Community-Based Health Insurance Schemes in Low- and Middle-Income Countries? A Systematic Review and Meta-Analysis. PLoS One. 2016;11(8):e0160479.

- Osungbade KO, Olumide A, Balogun O, Famakinwa EO, Jaiyeoba O. Social Health Insurance in Nigeria: Policy Implications in A Rural Community. Nigerian Medical Practitioner [Internet]. 2010 [cited 2021 Apr 27];57(5–6). Available from: https://www.ajol.info/index.php/nmp/article/view/57840

- Agago TA, Woldie M, Ololo S. Willingness to join and pay for the newly proposed social health insurance among teachers in Wolaita Sodo town, South Ethiopia. Ethiopian journal of health sciences. 2014;24(3):195–202.

- Wasike M, Gachohi J, Mutai J. Factors influencing the uptake of health insurance schemes among Kibera Informal Settlement Dwellers, Nairobi, Kenya. East African Medical Journal. 2017;94(10):863–72.